One thing missing from this mortgage calculator is balancing the risks associated with financing a second home as collateral. Some scenarios and loan programs will allow for the total debt to income ratio up to 55% if the overall credit profile is strong enough. But, these figures can vary depending on the loan type and the borrower’s overall credit profile. Lenders prefer that the total mortgage payment is roughly around 35% of the total pretax income and the total debts including the mortgage payment don’t exceed 50%. Additionally, properties that are in a flood zone, will require flood insurance and that is a figure that will need to be included. When calculating the monthly debts, don’t forget to add the taxes, insurance and homeowner association dues. A mortgage calculator can assist in calculating all sources of income and comparing them to all monthly debt payments. The person’s total monthly income and total monthly debt payments will be used to determine the total debt to income figure for the lender. Refinance mortgages will usually come with a better interest rate for standard home loans.

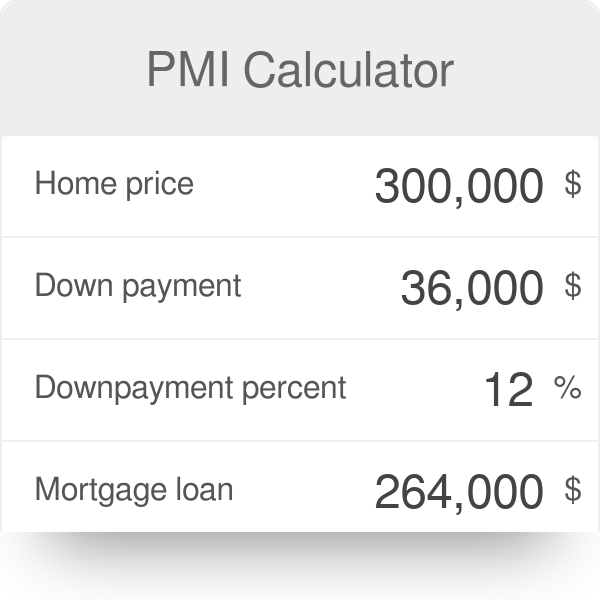

Florida Mortgage Calculator with PMI and Taxesįlorida mortgage calculators can be used to answer questions like: What will the monthly payment be if one borrows $250,000 at a 7% annual interest rate and repays the loan over thirty years, with $3,000 in annual property taxes, $1,500 in annual property insurance, and 0.5% in annual private mortgage insurance PMI? $2,142.89 is the correct answer.Īn online mortgage calculator can be used to determine how much property a potential borrower can afford for s conventional loan. These items should be considered by the new homeowners when establishing the home price before finalizing mortgage payments. When considering your new home value make sure to remember any credit card debt, home property taxes, closing costs and any cash available for your home down payments. This will give you a mortgage payment range so that you are prepared for differences between your numbers and the actual number. Always change the data so that you have numbers from multiple scenarios in case the rate or mortgage amount is different. Once inputting all the factors and the basic data that is applicable to your particular situation, the calculator will give the payment based on the information submitted. We have included a Florida mortgage payment calculator on the above page for your use and to help determine approximate loan payments.

ONLINE MORTGAGE CALCULATOR WITH PMI SOFTWARE

There are also a plethora of free online mortgage calculators and software packages available that perform financial and mortgage calculations.

ONLINE MORTGAGE CALCULATOR WITH PMI PORTABLE

Portable Financial calculators like the HP-12C and the Texas Instruments TI BA II Plus have additional mortgage calculation features. Other costs linked with a mortgage, such as property taxes and insurance, can be calculated using more advanced calculators. The loan balance, interest rate and total number of payments are all important elements to consider when calculating a mortgage. Mortgage lenders use our mortgage calculator Florida regularly to determine payments, debt to income ratios and make sure both are within the underwriting guidelines. Consumers use monthly mortgage payment calculators to calculate monthly payments and ensure they are looking in a price range they can afford. Our Mortgage Calculator for Florida above allow users to calculate the amortization and effects of changing one or more variables in a mortgage financing scenario. Always talk with an experienced loan officer to ensure your estimate for the rate, taxes and insurance are accurate. So, if your rate, taxes, insurance or any of the other data is not accurate, your mortgage payment won’t be accurate either. Keep in mind, the numbers you receive from the mortgage calculator are only as good as the data.

Simply, put the desired data and the mortgage calculator will determine the mortgage payment based on that data. Using our Florida mortgage calculator is the simplest way to calculate your mortgage payment.

0 kommentar(er)

0 kommentar(er)